You can begin taking Social Security benefits at any point after reaching age 62. Delaying increases your monthly benefit every month for up to eight years while you wait. This wide window creates a planning opportunity for people at or near retirement age. The optimal time to seize that opportunity is up to you. This article explores the implications of taking Social Security benefits early compared to delaying them.

Key Ages Affecting Social Security Benefits

While you become eligible for Social Security retirement benefits at age 62, they are at a reduced amount. There are two other ages that may influence the timing of your decision about when to apply.

The first is when you reach full retirement age. Full retirement age is 67 for the median-age American worker.1 The second is age 70.

Delayed retirement credits accrue every month you wait to take Social Security benefits beyond full retirement age. Those increases stop when you reach age 70.

These milestones trigger two important questions:

- Is it worth delaying benefits?

- What other variables apply?

Is it Worth Delaying Benefits?

Social Security retirement benefits are based on your highest 35 years of earnings. The higher your income, up to an annual taxable maximum, the higher your benefit.

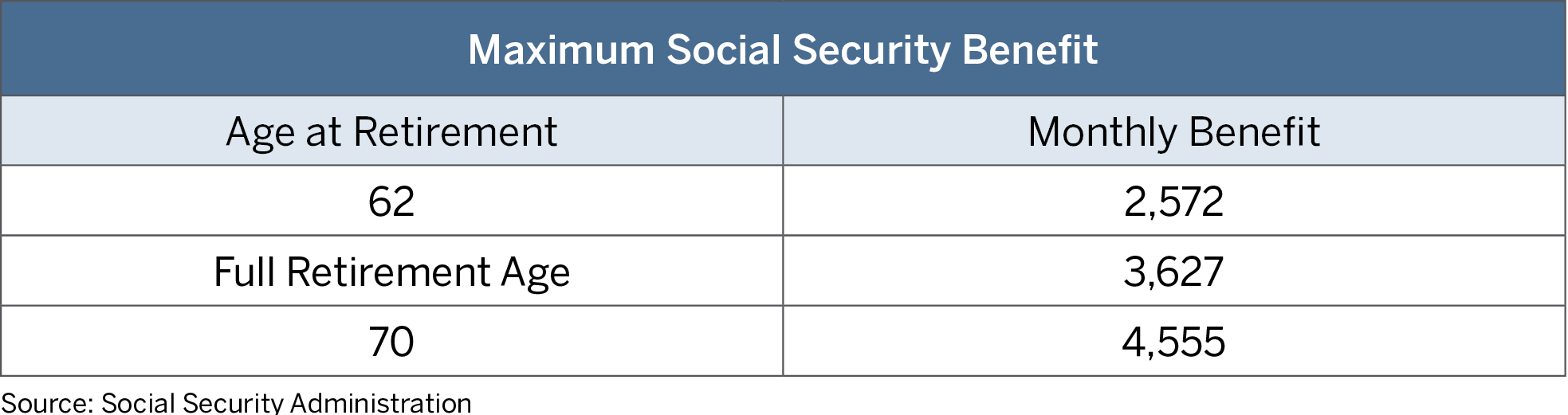

If your 35 highest earning years are at the taxable maximum, then you will be entitled to the maximum benefit, based on your starting age. It is important to note that not everyone is eligible for the maximum benefit.2

The table below shows the maximum retirement benefit available in 2023 at each starting age:

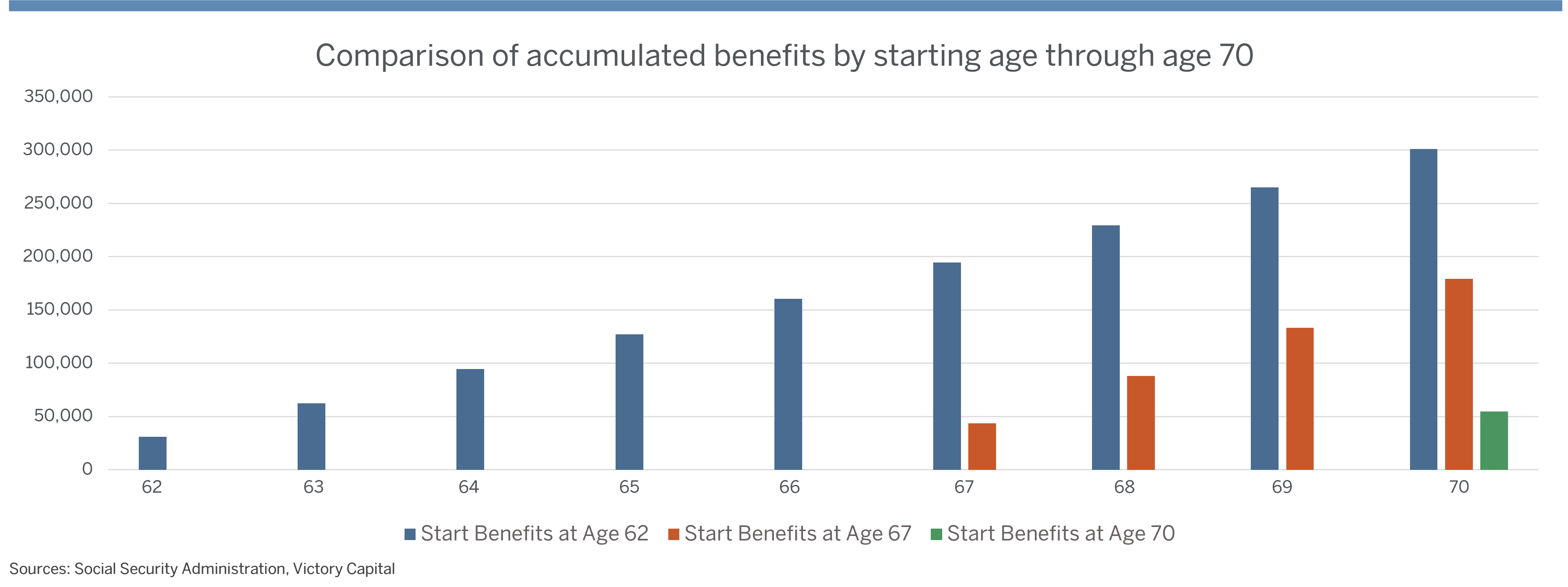

While benefits are higher if you wait, they come at the expense of missing out on up to eight years of income. The chart below illustrates the cumulative effect of this.

Delaying benefits until age 67 means you forgo more than $150,000. The lost income is almost $250,000 by age 70.3

But these numbers don’t tell the whole story.

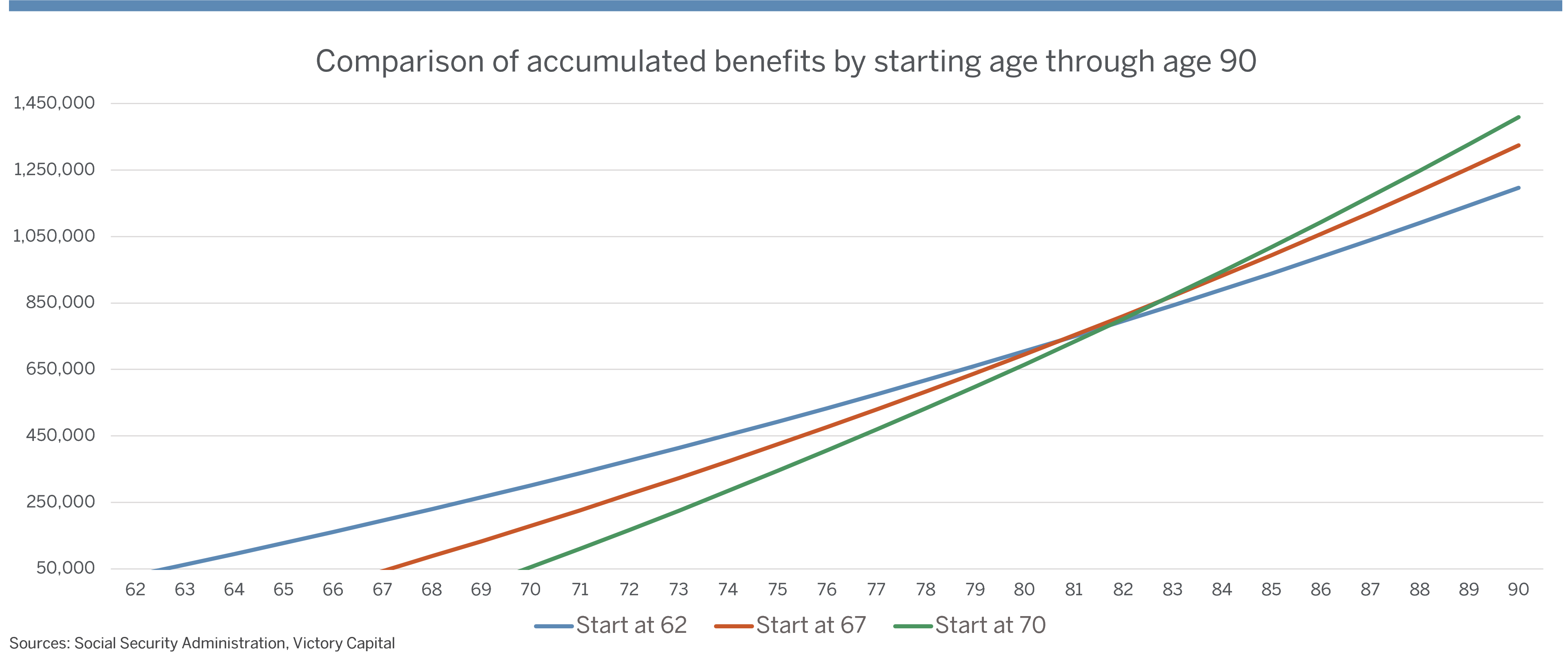

The longer you live past age 70, the more you make up for the initial shortfalls. You break even at about age 82, regardless of which age you start receiving benefits.

After that, cumulative benefits keep you ahead of where you would have been had you started at either age 67 or age 62.

Still, there are a number of variables affecting the decision of when to start.

What Other Variables Apply?

The optimal age to apply for Social Security benefits depends on your personal and financial circumstances. Personal issues may hold more weight than financial considerations.

For example, your health may require retirement before age 67. Caring for a spouse or loved one might be another consideration. Applying for benefits early may be necessary if you have no other means to finance retirement.

Applying for benefits early may create other complications.

For example, working before you reach full retirement age will further reduce your benefits if you earn more than a set limit. Working may also make your benefits taxable. Taking Social Security early may also reduce your spouse’s survivor benefit.

Those reductions would not apply if you delayed benefits until full retirement age. But your total combined income will still determine if a portion of your benefits are taxable.

Circumstances like these are why planning is so important. Our Retirement Planner Calculator shows how Social Security fits into a broader financial plan.

Working with experienced financial professionals can help you stay the course. They can provide guidance and encouragement to help focus your attention on your long-term goals.

[1] The median-age American worker is 41.7 years old. Source: U.S. Bureau of labor Statistics.

Full retirement age is 66 for people born between 1943 and 1954. Starting with those born in 1955, full retirement age is 66 and two months, with an additional two months added for each year a person is born after 1955 until 1959. Those born in 1959 reach full retirement age at 66 and 10 months. Everyone born after December 31, 1959 reaches full retirement age at 67. Source: Social Security Administration.

[2] Roughly 6 percent of covered workers have earnings above the taxable maximum every year. Source: Social Security Administration.

[3] This hypothetical illustration assumes an annual Cost-Of-Living Adjustment (COLA) of 2.00%. The average COLA since 1975 has been 3.68%. Source: Social Security Administration website: Latest Cost-Of-Living Adjustment.